Remitly is launching the Quid’s English Glossary, defining the top 25 confusing financial terms and slang in the UK including APR, Annuity, Liquidity, and more. This campaign is part of Remitly’s ongoing effort to provide financial education and literacy resources that address common barriers and help promote financial inclusion.

If you’ve ever been in a situation where conversation turns to money and suddenly everyone sounds like they are speaking a foreign language – this one’s for you. In a recent study¹, we asked 2,500 individuals about their experience with financial language. This research revealed that more than three fifths (65%) of the respondents have struggled to understand everyday financial terms, with more than a third of those polled (36%) claiming this has cost an average of £1,366 during their lifetime.

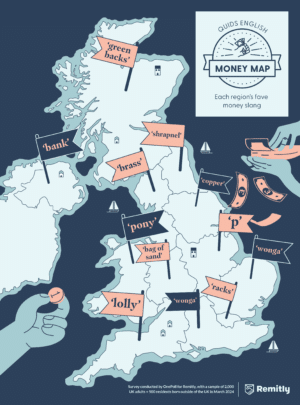

In our research, we saw that in addition to complex financial terms, understanding the UK’s colorful money slang can be even more confusing, with nearly half (45%) of all Brits and almost three quarters (74%) of the country’s non-native English speakers admitting to being baffled by it.

Financial Literacy Challenges Can be Costly

Navigating complex money terms and phrases can sometimes feel like decoding a secret language. Our research shows that when it comes to avoiding money mistakes, checking a dictionary is just as valuable as checking your maths, as being caught out by confusing financial terms has potentially cost people in the UK an estimated £26 billion during their lifetime.

To demonstrate the costly consequences of complex financial language, particularly for individuals living in the UK who speak English as a second language, participants of the research were asked about their experiences understanding and signing financial agreements. Responses showed that as a result of signing:

- Two fifths (40%) of non-native English speakers have regrets, compared to a third (34%) of native English speakers.

- Almost a quarter (23%) ended up paying more for something than they had previously expected, compared to less than a fifth (16%) of native English speakers.

- One fifth (19%) have paid interest or late fees, compared to a tenth (12%) of native English speakers.

- Almost a fifth (16%) have paid more tax than expected, compared to less than a tenth (9%) of native English speakers.

This is Where Quid’s English Steps in

To help demystify the confusion that comes with discussions about money, we created the Quids English Glossary which contains 25 confusing financial terms and slang that will support anyone in the UK trying to navigate the many nuances of money language. Aiming to increase financial literacy is our way of promoting financial inclusion and helping to improve outcomes for individuals with cross border financial services needs.

“Moving to a new country presents unique challenges, especially when it involves navigating the complexities of new financial systems and learning new financial slang and terminology. The learning curve can be daunting, even costly, and it can often create barriers to accessing essential financial services.” says Danielle Treharne, Vice President of Business Management at Remitly, and adds that “At Remitly, we’re constantly looking for ways to improve our customers’ experience and to better understand their challenges. We believe in providing financial education and literacy resources that address common barriers – which is what inspired the launch of Quid’s English. We hope this work will help promote financial inclusion and support individuals with cross border financial services needs.”

Top 10 Confusing Financial Terms

- APR – Annual Percentage Rate

- Sub-prime lending

- In perpetuity

- Compound interest

- Annuity

- Progressive tax rates

- Variable interest rate

- Capital gain

- Liquidity

- Arrears

Top 10 Slang Phrases Used to Talk About Money and Finance

- Skint

- A rip-off

- To make ends meet

- Daylight robbery

- Rainy day fund

- Loaded

- An arm and a leg

- Bank of mum and dad

- Quids in

- Burning a hole in my pocket

¹A poll of 2,500 adults across the UK, including 500 adults who did not speak English as their first language, conducted by OnePoll between 15-27 March 2024.

This publication is provided for general information purposes only and is not intended to cover all aspects of the topics discussed herein. This publication is not a substitute for seeking advice from an applicable specialist or professional. The content in this publication does not constitute legal, tax, or other professional advice from Remitly or any of its affiliates and should not be relied upon as such. While we strive to keep our posts up to date and accurate, we cannot represent, warrant or otherwise guarantee that the content is accurate, complete or up to date.